You may have seen those fashion magazines where they have pictures of people wearing clothes the right way and the wrong way. On the wrong way pictures, they usually put a black box over the person’s face to hide the shame of wearing a meat dress or tights as pants. At The Law Offices of John Day, P.C., we wanted to give you some legal DOs and DON’Ts. Continue reading

Articles Posted in Insurance

Dogs: Man’s Best Friend (Usually)

Roughly 44% of all U.S. households have a dog. Ours has a tri-color King Charles Cavalier named Lincoln (pictured above). Lincoln and most other dogs are wonderful companions, protectors, and exercise buddies, but when they want to dogs can inflict a lot of damage primarily due to their bite pressure. So just how strong is a dog’s bite? Continue reading

Protect Yourself: Driving Fatalities at their Highest Since 2007

Last year, 40,200 people lost their lives in car accidents. Think about that. 40,200 lives cut short. 40,200 funerals. 40,200 families mourning the loss of a loved one. For more perspective on that, the Chicago White Sox stadium holds 40,615 people, so we lost almost a stadium full of people to car accidents last year. The death toll represents a 6% increase over 2015 and a 14% increase over 2014. Experts attribute the rise in deaths to a number of factors and, of course, have offered suggestions to protect yourself. Continue reading

Advice From a Lawyer on the New Year’s Resolutions You Should Make

As the New Year approaches, many start to think about improvements they want to make in their lives for 2017. At The Law Offices of John Day, P.C., our work involves helping people who have been injured in accidents and, since most accidents are preventable, we thought we would give you some New Year’s resolutions that can help protect you and others. The best part of these resolutions is, for the most part, they are easy and painless to implement (unlike that weight resolution most of us make). Here are our recommendations:

- Check your auto insurance and make sure you have uninsured/underinsured motorist coverage. I can’t tell you how often someone calls our office with significant injuries from a car accident who cannot recover any money because the driver who caused the accident did not have insurance and the client did not have uninsured/underinsured motorist coverage. We have written a number of posts about uninsured/underinsured motorist coverage and you can find them here, here, here and here. But, our number one piece of advice to protect yourself would be to purchase uninsured/underinsured motorist coverage with as high of limits as you can afford. You will truly be surprised at how cheap it is and it can mean the difference between receiving compensation for your medical bills, lost wages and injuries and receiving nothing.

- Wear your seatbelt. They save lives. Period.

Safest and Most Affordable Cars for Teens

If you have kids, you probably have mixed emotions about them getting their driver’s license. Jubilation because they can run to the grocery store for you, get themselves to sports practice without you having to leave work early, etc. But it can also be a terrifying time and with good reason. Motor vehicle crashes are the leading cause of death for teens.

Recently, Mercury Insurance released a list of 2016 model year vehicles that had both good safety ratings and were inexpensive to insure. Based on these criteria, the winners were: Subaru Outback, Kia Sportage, Dodge Dart, Kia Soul, Honda HR-V EX, Hyundai Tuscon, Honda Fit , Honda CR-V LX, Hyundai Elantra GT, VW Golf Sportwagen SW. I know. I can hear some of you already: “There is no way I am buying my teenager a brand new car”. I get it. Our two older kids did not get new cars either. The good news is you can do this same type of comparison yourself for used cars. Continue reading

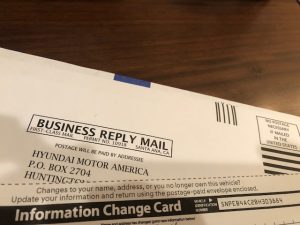

Trying To Be Cheap When Purchasing Insurance Could Cost You

Last week, a question was posted on Avvo (a legal Q & A site) seeking advice about what should be done following a car accident. The questioner was worried about getting sued, and the primary source of his anxiety was because he had substantial assets including investment accounts but he only had $100,000 in automotive insurance coverage. In particular, he wanted to know if he should hire his own lawyer separate and apart from any lawyer hired by his insurance company? Before I get to that, let me start with something more important. Continue reading

Winter Weather Driving and Car Insurance

Well it is finally here: winter weather. If you have to get out and about in it, here are some winter driving tips along with a very important piece of advice about your insurance. Continue reading

Need Help with Those New Year’s Resolutions?

So, it is January 4th. How many of your New Year’s resolutions are already busted? If you are like most of us, it is probably at least one. That is the bad news. But, here is the good news: below is a list of 10 easy New Year’s resolutions that are easier than losing 10lbs and will help keep you safe and prepared in 2016. Continue reading

Still Driving Despite 17 DUIs and a Suspended License: How to Protect Yourself From Folks Like This

Earlier this month, a Shelbyville woman was arrested for her 17th DUI. No, that is not a typo– seventeen DUIs. According to reports, the habitual drunk driver was arrested yet again after she crossed the center-line and crashed head-on into another vehicle injuring the other driver.

Of course, given her driving record, this woman should not have been driving and, in fact, her license was suspended. But she was nonetheless out on the roadways again and almost certainly she was not insured. Tragically, this is not an isolated occurrence. Fifty to seventy-five percent of drunk drivers will continue to drive on a suspended license. If the drunk driver does not have any insurance, where does it leave the innocent victim injured by this woman’s criminal conduct? Continue reading

What Is “Medical Payments” Insurance Coverage in Tennessee?

Medical payments insurance coverage, typically called "med pay," is a type of insurance coverage that is often a part of automobile liability insurance policies in Tennessee. It pays medical bills that arise out of an automobile accident, even if the accident is your fault. Medical payments coverage is typically $5000 or $10,000, although I have seen coverage as high as $25,000.

Med pay coverage can help you meet deductible and co-pays on your health insurance policy.

Most automobile insurance policies give the insurance company the right of subrogation if med pay is paid. This means that you get hurt in a wreck caused by someone else’s negligence and collect med pay benefits, you have to re-pay your insurance company if you collect monies from the person who caused the wreck. There are some legal limitations on this right – please be sure to ask an experienced Tennessee automobile car accident lawyer about your rights.

Tennessee Injury Law Center

Tennessee Injury Law Center